The Stonewell Bookkeeping Ideas

Wiki Article

Some Of Stonewell Bookkeeping

Table of ContentsTop Guidelines Of Stonewell BookkeepingExcitement About Stonewell BookkeepingThe Definitive Guide to Stonewell BookkeepingThe Best Guide To Stonewell BookkeepingThe Ultimate Guide To Stonewell Bookkeeping

Most recently, it's the Making Tax Digital (MTD) campaign with which the government is expecting companies to abide. best franchises to own. It's precisely what it states on the tin - services will need to begin doing their tax obligations digitally through making use of applications and software. In this instance, you'll not just need to do your publications however additionally use an app for it also.You can relax simple recognizing that your business' economic details is all set to be examined without HMRC providing you any type of stress and anxiety. Your mind will be at simplicity and you can concentrate on various other areas of your service. It does not matter if you're a total rookie or a bookkeeping veteran. Doing digital bookkeeping uses you a lot of possibilities to discover and complete some understanding spaces.

The Ultimate Guide To Stonewell Bookkeeping

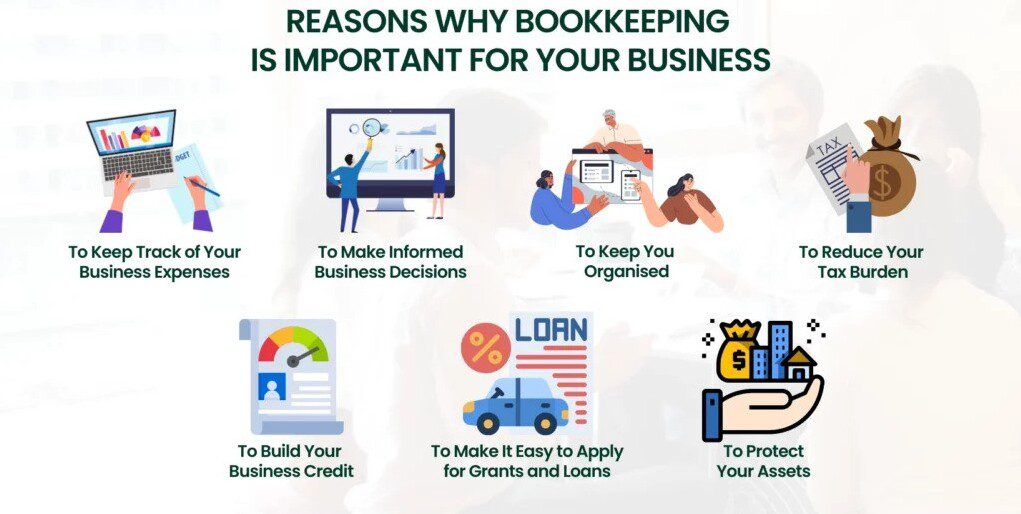

Accounting is essential for a little organization as it helps: Display economic health and make notified decisions, including money circulation. Mobile accounting applications provide numerous advantages for little service proprietors and business owners, simplifying their monetary management tasks (https://picturesque-banjo-03b.notion.site/Bookkeeping-The-Secret-Ingredient-to-Your-Business-Success-2cbf4baeeb2e80ad8c5ec5e55b1efc15?source=copy_link).Several modern accountancy apps permit individuals to link their checking account directly and sync the transactions in real time. This makes it easier to check and track the revenue and costs of the company, getting rid of the demand for manual access. Automated attributes like invoicing, expense tracking, and importing financial institution purchases and bank feeds save time by lowering manual information access and improving bookkeeping procedures.

Additionally, these applications decrease the demand for hiring extra team, as many jobs can be handled in-house. By leveraging these benefits, small service proprietors can improve their economic management procedures, enhance decision-making, and concentrate much more on their core company procedures. Xero is a cloud-based audit software program that helps small companies quickly manage their audit documents.

Additionally, these applications decrease the demand for hiring extra team, as many jobs can be handled in-house. By leveraging these benefits, small service proprietors can improve their economic management procedures, enhance decision-making, and concentrate much more on their core company procedures. Xero is a cloud-based audit software program that helps small companies quickly manage their audit documents.when you're choosing based on uncertainty instead of data. That "rewarding" customer could actually be costing you money when you element in all expenses. That project you believed was recovering cost? It's been haemorrhaging cash money for months, but you had no chance of understanding. The Australian Taxes Workplace does not play around, browse around here either.

About Stonewell Bookkeeping

Since they're making choices based on strong information, not estimates. Your accounting exposes which services or items are genuinely rewarding, which clients are worth maintaining, and where you're investing unnecessarily. https://fliphtml5.com/homepage/hirestonewell/hirestonewell/.

Below's a useful contrast to assist you determine: FactorDIY BookkeepingProfessional BookkeepingCostSoftware fees only (less expensive upfront)Solution costs (normally $500-2,000+ monthly)Time Investment5-20+ hours per monthMinimal evaluation records onlyAccuracyHigher error danger without trainingProfessional precision and expertiseComplianceSelf-managed risk of missing out on requirementsGuaranteed ATO complianceGrowth PotentialLimited by your readily available timeEnables concentrate on core businessTax OptimisationMay miss out on reductions and opportunitiesStrategic tax planning includedScalabilityBecomes overwhelming as organization growsEasily ranges with business needsPeace of MindConstant worry about accuracyProfessional guarantee If any of these audio acquainted, it's possibly time to bring in a specialist: Your company is growing and purchases are increasing Bookkeeping takes even more than 5 hours weekly You're registered for GST and lodging quarterly BAS You employ team and manage pay-roll You have multiple income streams or bank accounts Tax obligation season loads you with genuine fear You would certainly instead concentrate on your actual innovative work The truth?, and expert bookkeepers recognize how to leverage these devices properly.

The Definitive Guide to Stonewell Bookkeeping

Maybe particular jobs have far better settlement patterns than others. Also if marketing your organization seems remote, preserving clean economic documents develops enterprise worth.You might additionally pay too much tax obligations without correct documents of reductions, or face problems during audits. If you uncover errors, it's essential to remedy them promptly and amend any type of damaged tax obligation lodgements. This is where professional accountants show vital they have systems to capture errors before they end up being expensive troubles.

At its core, the primary distinction is what they make with your financial data: handle the daily tasks, including recording sales, expenditures, and bank settlements, while maintaining your general ledger as much as date and exact. It's about getting the numbers appropriate regularly. action in to analyse: they take a look at those numbers, prepare monetary declarations, and interpret what the information actually indicates for your business growth, tax obligation placement, and success.

All about Stonewell Bookkeeping

Your company decisions are just just as good as the documents you have on hand. It can be hard for company owner to individually track every expenditure, loss, and revenue. Keeping exact documents calls for a great deal of job, even for tiny organizations. For instance, do you understand just how much your organization has invested in payroll this year? Just how about the quantity invested in supply so far this year? Do you know where all your invoices are? Business tax obligations are intricate, time-consuming, and can be stressful when attempting to do them alone.Report this wiki page